NFT Market Value Chart

Greetings, NFT Enthusiasts! In this article, we will delve into the world of NFT market value charts and explore their significance in the digital art and collectibles industry. If you’re passionate about non-fungible tokens and want to understand how their value is determined, then you’re in the right place. Let’s dive in!

Introduction

NFTs, or non-fungible tokens, have taken the digital world by storm. These unique digital assets are authenticated using blockchain technology, making them rare and valuable. As the popularity of NFTs continues to rise, the need for tracking their market value becomes crucial. That’s where NFT market value charts come into play.

NFT market value charts provide a visual representation of the value fluctuations of different NFTs over time. They allow collectors, investors, and enthusiasts to analyze trends, identify potential investment opportunities, and make informed decisions. These charts are generated by aggregating data from various NFT marketplaces and platforms.

Now, let’s explore the key aspects of NFT market value charts:

1. What is an NFT Market Value Chart?

Image Source: techcrunch.com

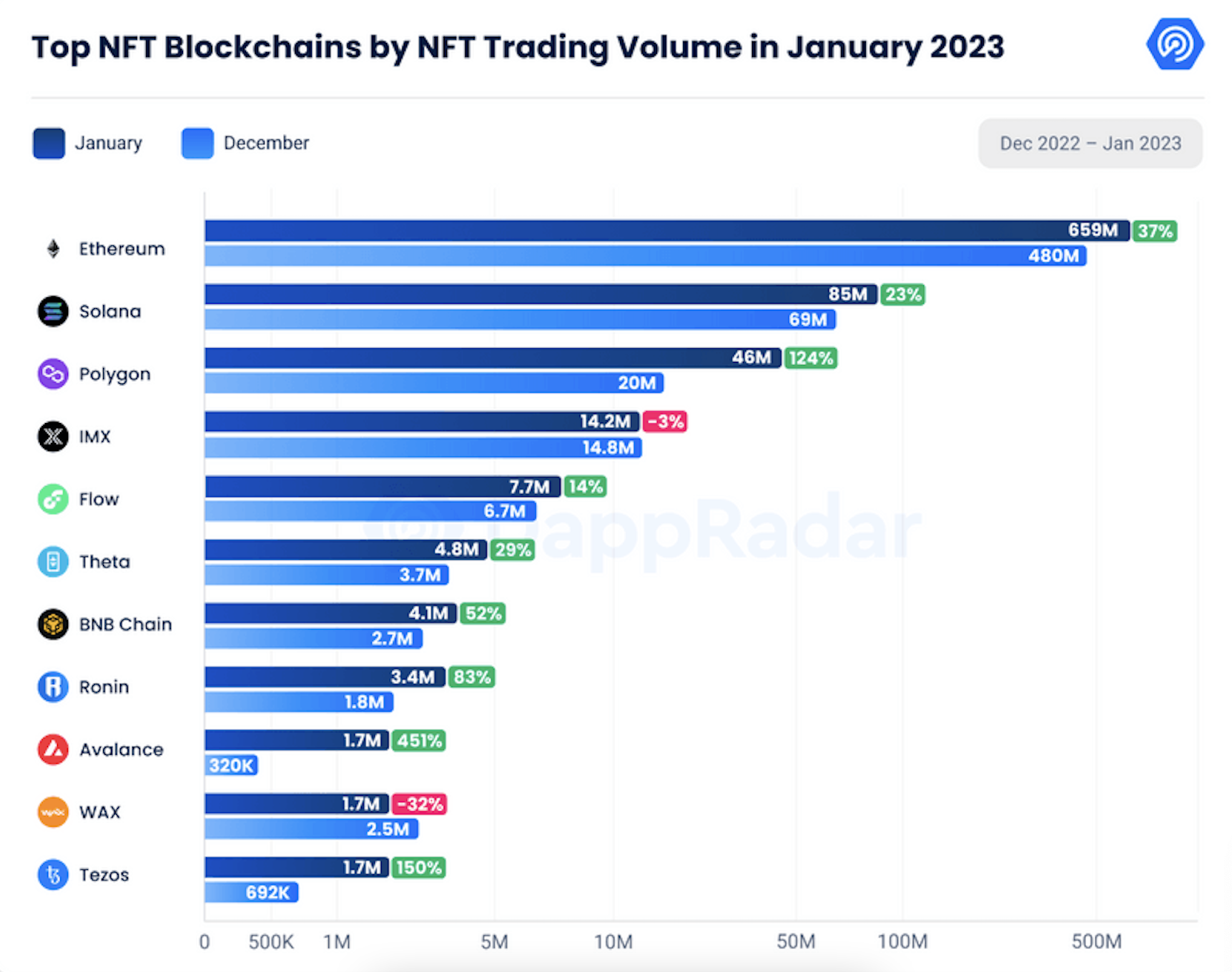

An NFT market value chart is a graphical representation of the market value of NFTs. It illustrates the price movements, trading volume, and other relevant data related to specific NFTs or collections. These charts can be viewed in real-time or historical data, helping users gain insights into the market dynamics.

2. Who Uses NFT Market Value Charts?

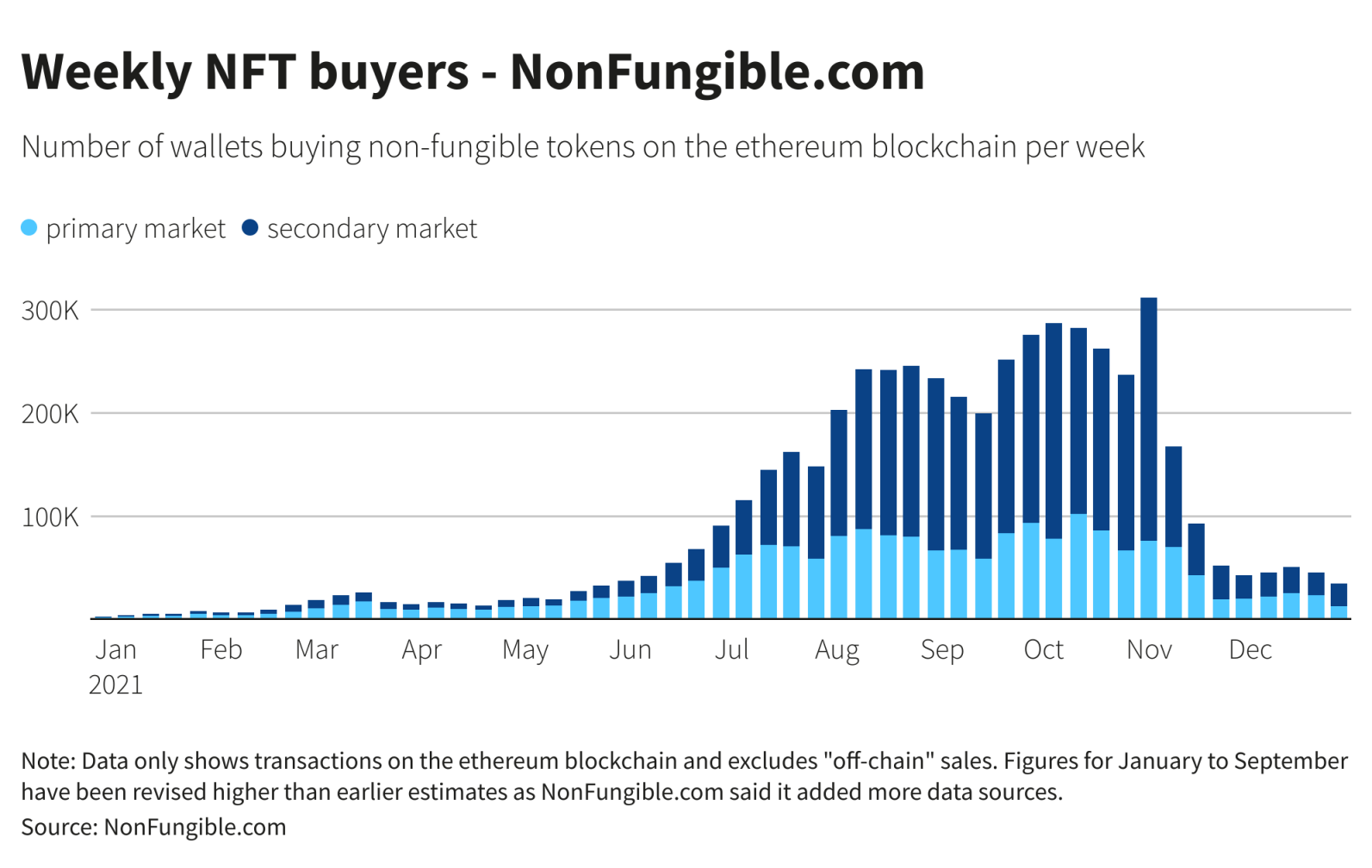

NFT market value charts are beneficial for various individuals and entities involved in the NFT ecosystem. Artists can track the value of their creations and adjust their pricing strategies accordingly. Collectors and investors can identify potential NFTs with high growth potential or determine the right time to buy or sell. NFT marketplaces and platforms can utilize these charts to attract users and provide a transparent trading environment.

3. When Should You Refer to an NFT Market Value Chart?

Referring to an NFT market value chart is essential before making any investment or purchasing decisions. By analyzing the chart, you can identify trends, spot opportunities, and assess the potential risks associated with a particular NFT. Whether you are a buyer, seller, or investor, keeping an eye on the market value charts is crucial for maximizing your gains.

4. Where Can You Find NFT Market Value Charts?

Image Source: arcpublishing.com

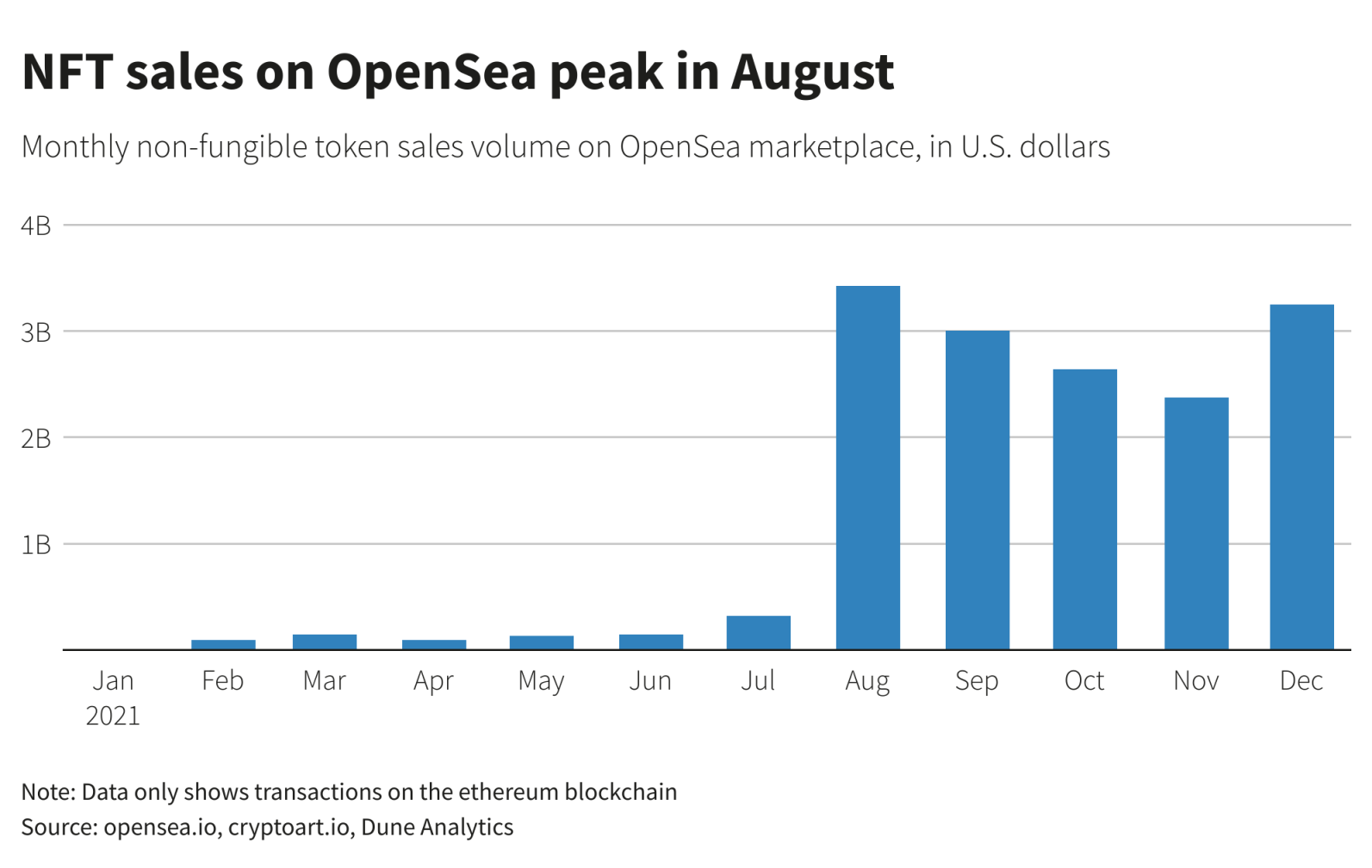

NFT market value charts are available on various platforms and websites. Some of the popular platforms that provide comprehensive market data and charts include OpenSea, Rarible, SuperRare, and Nifty Gateway. These platforms offer users the ability to track individual NFTs, collections, and the overall market performance.

5. Why are NFT Market Value Charts Important?

NFT market value charts play a vital role in the NFT ecosystem for several reasons. Firstly, they provide transparency by allowing users to access real-time and historical data, making the market more open and accountable. Secondly, these charts facilitate market analysis, enabling individuals to make informed decisions based on trends and patterns. Lastly, NFT market value charts contribute to the overall growth and maturation of the NFT industry.

6. How Can You Interpret an NFT Market Value Chart?

Image Source: arcpublishing.com

Interpreting an NFT market value chart requires an understanding of the various elements it presents. The price movements on the chart indicate the value fluctuations of the NFT over time. The trading volume represents the number of transactions occurring for that NFT, reflecting its popularity and demand. Additionally, indicators such as average sale price, price changes, and market cap can provide valuable insights into the NFT’s performance.

Advantages and Disadvantages of NFT Market Value Charts

Advantages

1. Valuable Insights: NFT market value charts offer users valuable insights into the performance and trends of specific NFTs, enabling informed decision-making.

2. Risk Assessment: By analyzing market value charts, individuals can assess the potential risks associated with investing in a particular NFT, reducing the chances of financial loss.

3. Increased Transparency: NFT market value charts enhance transparency in the NFT market by providing open access to pricing information, enabling a fair trading environment.

4. Identification of Opportunities: These charts allow users to identify potential investment opportunities and capitalize on emerging trends within the NFT space.

5. Pricing Strategy: Artists and creators can utilize NFT market value charts to adjust their pricing strategies based on the demand and market value of their digital creations.

Disadvantages

1. Volatility: The NFT market is highly volatile, and market value charts may not always accurately represent the future value or performance of an NFT.

2. Limited Historical Data: As the NFT market is relatively new, historical data may be limited, making it challenging to predict long-term trends accurately.

3. External Factors: Market value charts may not consider external factors such as market sentiment, celebrity endorsements, or regulatory changes, which can significantly impact an NFT’s value.

4. Data Accuracy: It’s crucial to ensure the accuracy and reliability of the data used in NFT market value charts, as inaccuracies can lead to misleading insights and decisions.

5. Emotional Decision-making: Relying solely on market value charts can lead to emotion-driven decision-making, potentially overlooking other important factors.

Frequently Asked Questions (FAQ)

1. Are NFT market value charts only applicable to digital art?

No, NFT market value charts are not limited to digital art. They are applicable to various NFT categories, including collectibles, virtual real estate, music, domain names, and more.

2. Can NFT market value charts predict the future value of an NFT?

While NFT market value charts provide insights into past performance and trends, they cannot accurately predict the future value of an NFT due to the market’s inherent volatility.

3. Should I solely rely on NFT market value charts when making investment decisions?

No, it’s essential to consider other factors, such as the uniqueness and appeal of the NFT, the reputation of the creator, and the overall market sentiment, in addition to analyzing market value charts.

4. How frequently should I check NFT market value charts?

The frequency of checking NFT market value charts depends on your level of involvement and investment goals. However, it’s recommended to regularly monitor the market to stay updated on trends and potential opportunities.

5. Can I create my own NFT market value chart?

Yes, if you have access to relevant data and the necessary technical skills, you can create your own NFT market value chart. However, utilizing established platforms and websites is often more convenient and reliable.

Conclusion

In conclusion, NFT market value charts serve as valuable tools for NFT enthusiasts, artists, collectors, and investors. They provide insights into market trends, help assess risks, and enable informed decision-making. While they have advantages, it’s crucial to consider the limitations and external factors that can impact an NFT’s value. By utilizing NFT market value charts effectively, individuals can navigate the dynamic NFT landscape with greater confidence and success.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or investment advice. The NFT market is highly speculative and volatile, and individuals should conduct their own research and seek professional advice before making any investment decisions. The authors and publishers of this article do not assume any responsibility for financial losses incurred by readers.